The Geopolitics of submarine cables and the “PEACE” project

- Valentina Benzi

- Nov 19, 2023

- 4 min read

Source: Flickr

1. The Internet Feud

There is no doubt that the submarine cable network has currently reached the status of critical infrastructure; the roughly 400 presently functioning cables handle almost 99% of data circulating on the planet, which makes them highly exposed targets to the risk of intentional sabotage. In fact, damaging specific cables would imply paralyzing a country’s entire internet communications network and redirecting the traffic to the next available alternative with the risk of malfunctions and security leaks.

Moreover, even though the data voyaging through the cables can be encrypted, it remains possible to extract metadata useful for commercial intelligence gathering, on top of controlling the flow of sensitive data at landing points.

Controlling the flow of data through submarine cables has therefore become crucial and the strongest players in the sector, especially the USA and China, are fighting over the ownership and management of this kind of infrastructure.

The USA and its allies (such as Australia and Japan) have voiced concerns over the progressive integration of the role of owners, operators and cloud providers of submarine internet cables in the hands of Chinese companies with strong ties to Beijing, which would pose the risk of facilitating espionage. Moreover, the US and allied countries have also actively prevented Chinese-oriented projects from coming into fruition more than once, one example could be the retirement of Facebook Inc. consortium from a project to lay a cable from California to Hong Kong in 2021 following pressure from the government. On the other hand, a different approach can be observed regarding some telecom companies based in EU member countries, which have been leaning towards participating in Chinese backed projects in Africa and the Mediterranean.

2. PEACE

One recent embodiment of the current Internet feud is the “PEACE” (“Pakistan and East Africa Connecting Europe”) cable.

It is a now fully functional submarine optic fiber cable connecting Pakistan to South Africa and the East coast of Africa with final destination Marseille, France.

The project first started in 2017 and became fully operational in December 2022 as announced by PEACE Cable International Network Co., Ltd., the consortium of companies that funded its laying on the ocean floor.

The lion’s share of the ownership belongs to the Chinese Hengtong and its subsidiary, Huawei Marine, while another relevant partner is Orange, a French company managing the landing point in Marseille.

It is an installation promoted under the “One Belt, One Road” national Chinese infrastructure strategy which made China the main competitor of the USA in the submarine cables market in a matter of a few years.

The PEACE consortium successfully built an alternative to EASSy, another cable serving Africa’s east coast, which is mainly African owned.

Peace Cable System Map, retrieved from:

3. Geopolitics

China’s strategy comes from the Belt and Road initiative of exactly ten years ago which initiated a series of investments in target countries aimed at building an integrated infrastructure network. The digital telecommunication side of the strategy is referred to as the “Digital Silk Road”, which also comprises undersea cable ventures.

Through the investments in infrastructure introduced with the “One Belt, One Road” strategy, China will be able to become an essential player of the global supply chain, and take on the role of global service provider.

In this strategy, the Mediterranean is a key region and is being targeted as a potential market for digital communication services.

The USA has been dominating the undersea internet cables market for years. In fact, Amazon, Google, Microsoft and Facebook owned or leased more than half of the world cable capacity in 2021 and that was also the case in 2023, but their standing could become uncertain due to the rapid emergence of Chinese actors such as Hengtong.

The US strategy is therefore aimed at maintaining their market share on top of developing the Mediterranean as a market for digital communication services.

The European Union has a cloud and 5G strategy, but it is excluded from the hardware market, where there is currently a serious strategic and regulatory gap.

There have been investments allocated to specific projects such as EllaLink in Latin America, but their volume is nowhere near enough to establish the EU as a competitive player in the market.

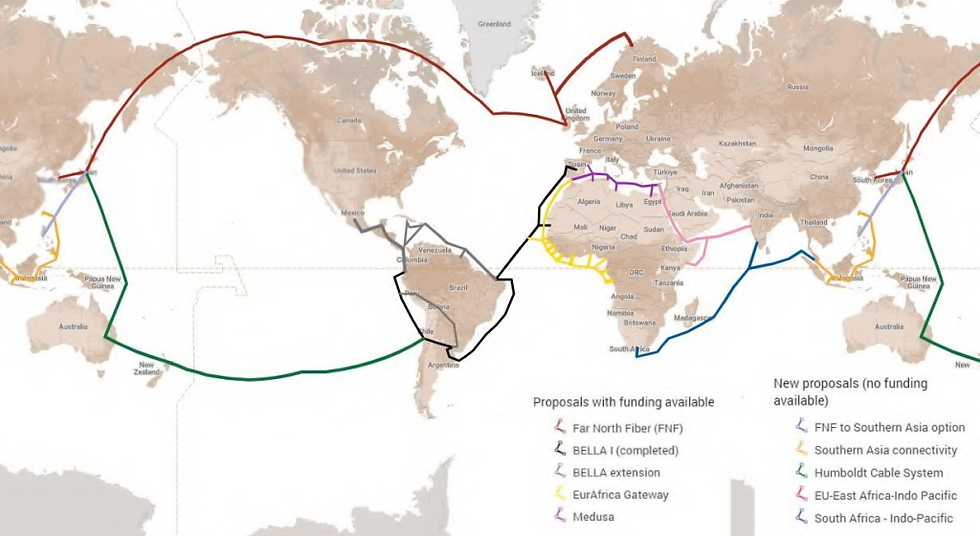

The only EU project in place for the development of an integrated infrastructure network is the Global Gateway initiative, which identifies Africa and Latin America as the main areas of interest for investments in digital infrastructure. Under this partnership, many projects that have been put forward are now awaiting funding, such as the MEDUSA optical fiber cable in the Mediterranean and the The EurAfrica Gateway cable along Africa’s west coast.

This October the Internal Market Commissioner Thierry Breton announced a new strategy for European infrastructure for 2024 which aims to open the road to a new Digital Networks Act. The commissioner also stressed the need to diversify suppliers and invest in a variety of data transmission infrastructure such as submarine and terrestrial cables and satellite-based communications to ensure a secure transmission of data.

Although the EU sees the need to create a coordinated submarine cable investment strategy, the conflicting national interests of member states pose difficulties that cannot be overlooked; many EU members either do not wish to be involved in global submarine cables projects for their inland positioning or are already carrying out important projects at national level.

Moreover, due to the lack of a harmonized approach to building an EU digital service network, companies from member countries with interests in the same areas (such as the Spanish Telxius, the Italian Telecom Italia Sparkle and the French Orange) are competing with each other and essentially preventing a harmonious development of the seafloor infrastructure.

In conclusion, the EU should rapidly rethink its strategy in order to be able to confront the more competitive players of the market and safeguard its interests in its neighboring areas.

European Commission’s presentation on Global Gateway, retrieved from:

Sources:

https://www.ispionline.it/it/pubblicazione/undersea-cables-great-data-race-beneath-oceans-30651

https://www.submarinenetworks.com/en/systems/asia-europe-africa/eass

https://www.submarinenetworks.com/en/systems/asia-europe-africa/peace/peace-cable-system-goes-live

https://media.defense.gov/2019/Jan/14/2002079292/-1/-1/1/EXPANDING-GLOBAL-ACCESS-REPORT-FINAL.PDF

https://ecfr.eu/publication/network-effects-europes-digital-sovereignty-in-the-mediterranean/

Comentários